J.C. Penny announced their quarterly results and the New York Times’ Andrew Ross Sorkin has weighed in with his assessment of the situation saying JCP executives are living in a “fantasy world.”

We are fascinated by this story because of the central issues at play. Two of the issues are critical marketing strategy questions – discounting and branding. We have mentioned them in our previous posts here and here and they are brought up again in Mr. Sorkin’s article. The third issue we are interested in is the process of attempting to change these deeply ingrained marketing strategies.

Anyone who works in the business world has spent mind-numbing hours in sessions about the necessity of change. You have inevitably been in a position where everyone around you said things must change or we’ll die. But so often when you actually pursue change you find precious few who will actually stand with you and a host of critics who say you live in a “fantasy world.” That is what makes Mr. Sorkin’s following statements ring so true.

There is something romantic about watching Mr. Johnson try to remake a dying classic icon. At some gut level, you have to root for him. He’s making a bold bet. Transitions are inherently painful. And everyone loves a great comeback story.

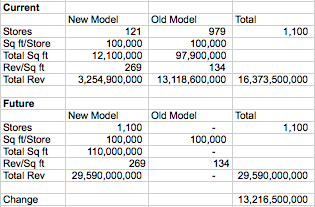

There are some interesting facts presented at the end of this article. (Remember – don’t rely on the headline or opening paragraph.) JCP has converted 11% of its stores to the new model and they are producing $269 in sales a square foot, versus $134 in the old stores. The article also says that it will take $1 billion to convert the remaining store.

Just a little back of the napkin math seems to indicate that JCP executives may have a little more to go on than pure fantasy. Based on what I’ve seen written, JCP has just over 1,100 stores averaging 100k square feet. Using the square foot sales mentioned above JCP could make an extra $13 billion in revenue if it converted all of its remaining stores.

That seems like a pretty good return on the $1 billion investment it will take to convert them. As Mr. Sorkin points out, the question is, will the losses get worse before they get better and JCP run out of cash before they can make the conversion?

I don’t have access to any inside info so if someone has better intel and can provide a more accurate calculation please do so. And please do not take this as investment advice and go out and buy JCP stock based on this. My point is simply that there are two perspectives on this transformation and it is interesting to watch this complex, real life marketing dilemma play out and root for JCP to become that great comeback story.

;

No comments yet.